Federal legislation ends a slew of energy efficiency tax credits; state and WEC incentives and rebates continue

The federal tax credit of up to $7,500 for new electric vehicles and up to $4,000 for used EVs ends September 30. A slate of other beneficial electrification incentives end December 31, 2025. These ending tax breaks were intended to combat climate change and reduce dependence on oil and natural gas by shifting Americans’ energy use to cleaner and more local and renewable sources.

For members who can benefit from an electric vehicle tax credit, now is the time to act. Keep in mind the incentives offered through Efficiency Vermont and WEC are not going away, and they are not tax credits. Most of them are rebates, and some are upfront discounts. Many of these incentives are scaled based on income, meaning that the lower your household income, the higher your rebate. Some bonuses are available to further reduce cost barriers for members below a certain income threshold.

“Despite the federal government’s retreat from combating climate change, WEC will continue to respond to our members’ wishes and support beneficial electrification, energy resilience, and renewable, locally generated energy,” said President Stephen Knowlton. “Our incentive policy is grounded in our shared belief that someone who can easily pay for an upgrade or benefit should not be subsidized by members who make significantly less money and may not be able to afford such upgrades or benefits themselves if our goal is to expand the use of clean electricity to everyone.”

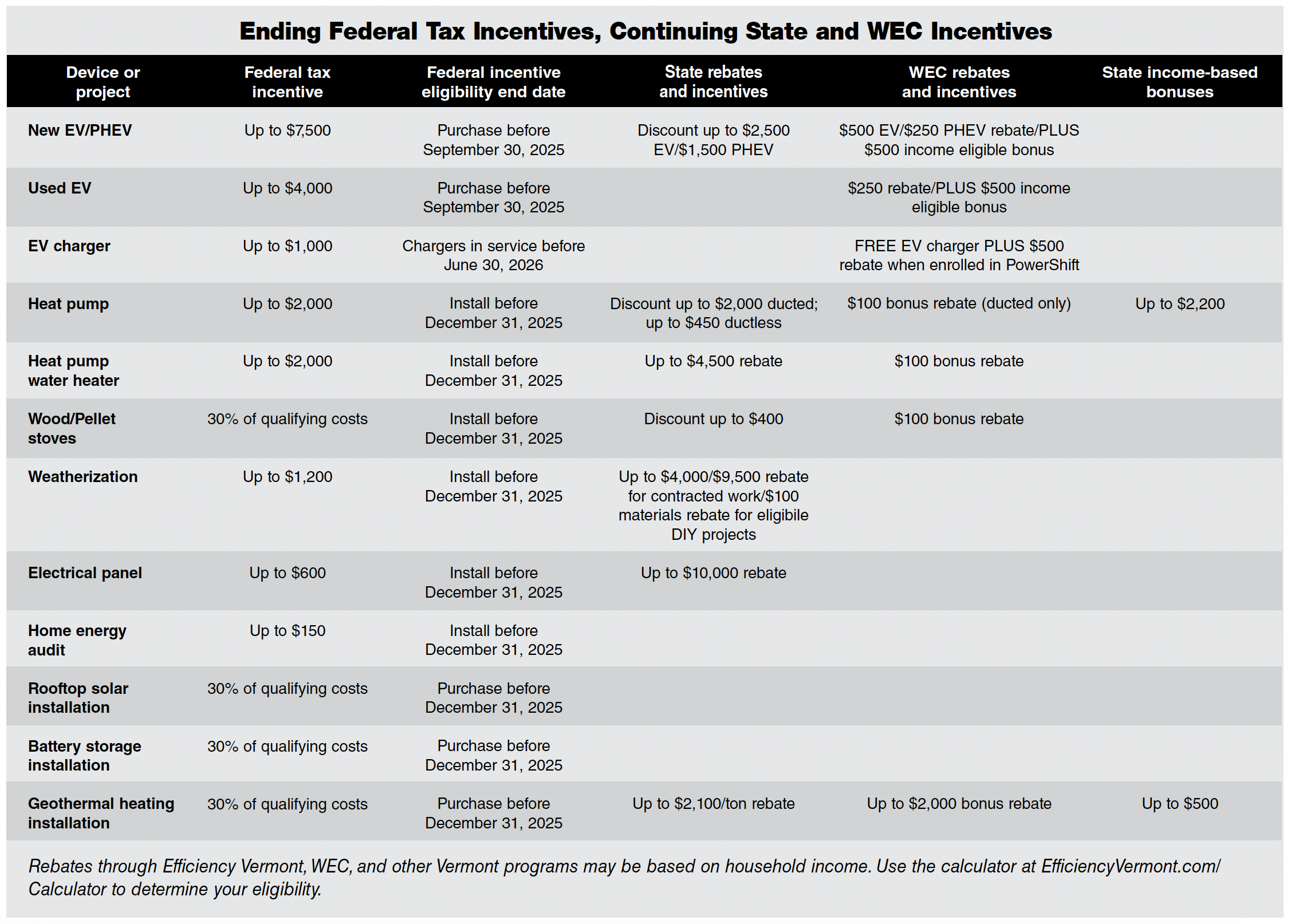

See the table below for tax credits and their end dates, and what incentives remain through Efficiency Vermont and WEC.

Ending Federal Tax Incentives, Continuing State and WEC Incentives