Treasurer’s Report

By Don Douglas

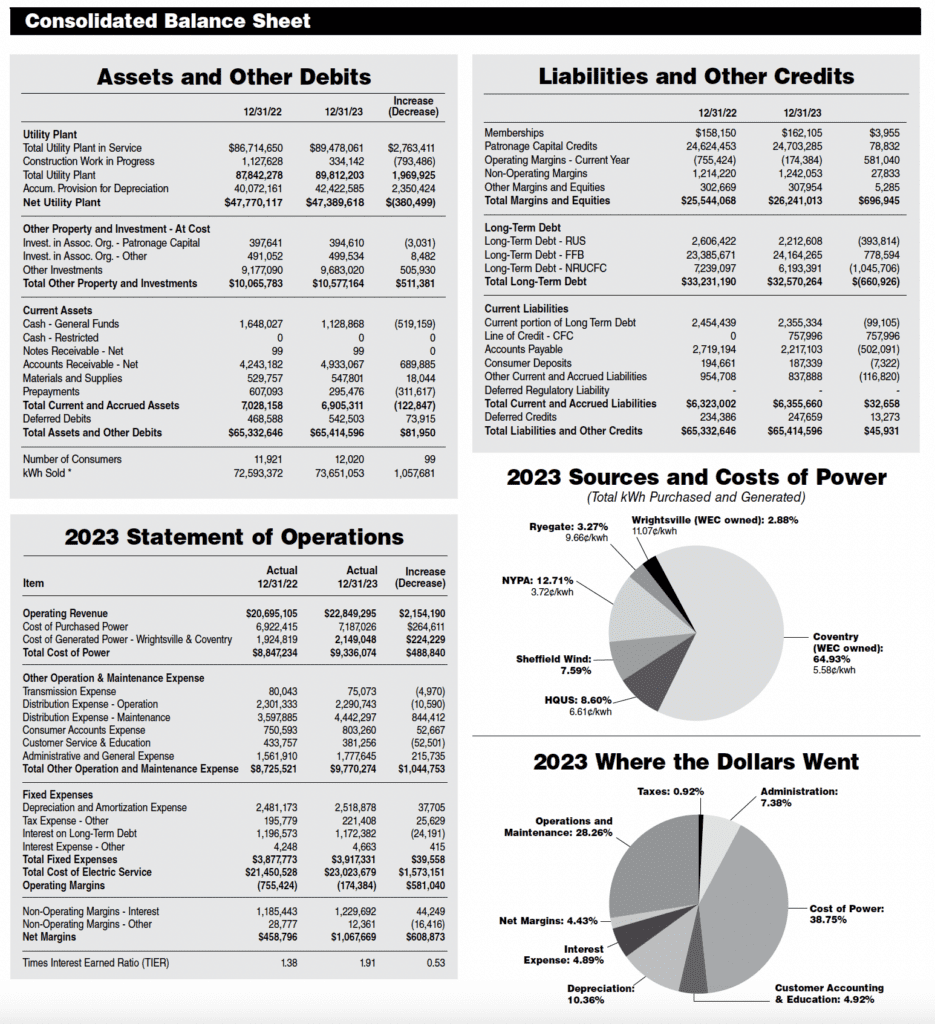

In 2023 Washington Electric recognized a large increase in revenue in retail sales. In 2022 it was $17,384,203 and in 2023 the figure increased to $20,246,823. This represents an increase of $2,862,620. This large increase is due to the rate increase of 12.83% and because our regulators asked us to shift the net generation credits down to purchase power instead of using those credits to reduce the expense of power generation. This shifted over $653,000 in 2023. The kilowatt hour sales increased 1.5% over 2022.

Coventry electric production has been a concern because there is plenty of gas available, but technical problems at the plant have increased the time the engines are either in repair or are unable to run at their capacity. WEC will most likely need to replace some of the equipment at the facility in order to utilize more of the available gas. When we have to flare the gas we are losing the opportunity to produce more electricity.

Outages in November and December were a large factor in the ever-increasing storm budget. We topped $1,100,000 in expenses in just two months. The storm expenses for the past five years demonstrate an alarming trend as the storms increase in intensity. WEC and all Vermont utilities continue to experience significant damage to the poles, wires, and all of the electric infrastructure.

We topped $1,100,000 in expenses in just two months. The storm expenses for the past five years demonstrate an alarming trend as the storms increase in intensity.

Sale of Renewable Energy Certificates (RECs) decreased slightly from $2,052,720 in 2022 to $1,978,302 in 2023. This reflects the problems of production at the Coventry plant and not the market value of the RECs.

The net margins in 2023 were $1,067,669, which is significantly more than in 2022, when the margins were $458,795. This increase in net margins comes from the rate increase on January 1, 2023 of 12.83% and the strong sales throughout the year.

Capital credits are one of the things unique to cooperatives. Investor owned utilities (IOUs) call the money in excess of what is needed to run the business “profits” and return that money to their investors, along with bonuses to their top level managers. Cooperatives call the money in excess of what is needed to operate the business “margins.” The margins are member revenues and get allocated to each member’s account based on each member’s usage. In short, WEC can return money to the members when there is excess at the end of the year. The Board of Directors is responsible for deciding if we can retire capital credits and how much to retire each year. Available cash is the metric we use to make this decision. Some years WEC has had very large allocations, and other years they are very small.

Our goal is to keep close to a 20 to 25 year cycle. Inactive members get a check in the mail if their credit exceeds $50. Active members get a credit on their November bill. Since we began retiring capital credits in 1998 WEC has returned nearly $10,000,000.

We also invite members to donate their capital credits to the Community Fund, which provides grants to nonprofit organizations in the four counties served by the Cooperative. This is a great way to make a real difference in your community. At present, over 1,400 members contribute a total of more than $35,000 each year. For more information, please call the Co-op at 802-223-5245 or visit wec.coop/capital-credits.

On behalf of the Board of Directors, I want to thank the entire Finance Department for their hard work and dedication to Washington Electric Cooperative.